We help our clients do more with less.

EO’s objective is to deliver user-friendly, solution-focused products which allow clients to address existing requirements. EO’s tools are complementary to the large, multi-year, “change the firm” IT programs often underway within many clients. While these programs are expansive in scope and objective – looking in some cases to address how data is fundamentally managed within the firm – because of their size, time to delivery and multiple sponsors, these programs can sometimes either miss current opportunities and challenges or not end as trading practitioner focused as might otherwise be the case.

EO’s products address current needs and can be used to help inform and provide analytical redundancy to these large IT programs.

For instance. EO’s CollateralEdge product is able to assist clients, even those facing significant big data quality challenges, in analysing and optimising their Derivatives collateral portfolios because its proprietary DataEdge methodology is able to work with the same user validated data driving their decisions today. Clients are therefore able to have the benefit of incremental optimisation analysis today, rather than at the end of an IT project, and to have it in the form that they want.

Core Products

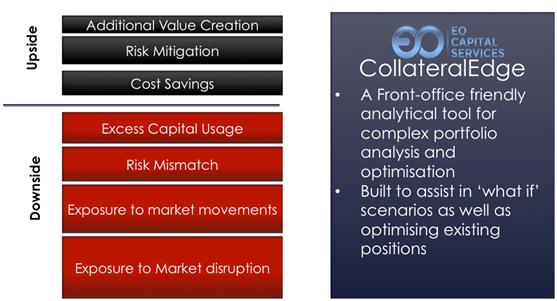

Starting with the Collateral Challenge: the optimisation potential embedded within the collateral required for the derivatives portfolios.

CollateralEdge from EO assists clients in analyzing clients collateral requirements and holdings. Utilising its proprietary optimization model, powered by IBM’s supercomputing platform, EO is able to help clients identify risk and value, whether in cost savings or capital release, in this dynamic and complex area.

EO has a number of further products currently under development, which also seek to bring further efficiency- combined with ease of use- to the market.

Advisory Services

In addition to its proprietary products, EO also offers a consultancy service to clients across pre and post trade portfolio optimisation to enhance Risk Adjusted Returns. EO is able to advise clients across multiple stages, from problem scoping and business case development to vendor analysis and selection to implementation integration and post implementation assurance.

CollateralEdge: Addressing Collateral Management Challenges

- As essential part of the derivatives market is collateral management. Every time there is trade, there is the risk of counterparty default. Collateral is the protection against counterparties blowing up. Collateral can be in the form of cash or bonds or gold or whatever is pre-agreed between the parties. Collateral levels for each trade are constantly changing. There is an estimated $10 trillion of collateral currently posted and levels are increasing.

What is Last Mile Optimisation?

- Chances are you are already doing some form of optimisation

- Most companies do some from of ‘sequential’ optimisation

- Moving to ‘holistic’ optimisation can produce significant additional benefit, but requires specialised know-how and technology – this is what is known as “Last Mile” Optimisation, and for users of Derivatives the difference can be significant not only in terms of cost savings or capital release, but also in terms of being able to carry out risk analysis, “what if” scenarios

- Existing Vendors charge £2-5M and take 12-18 months to come online

CollateralEdge Benefits

- See collateral capital costs and CSA optionality from the profit centre side

- Put front office managers in the driver’s seat

- Know if you are currently optimising, and exactly how much value is being left on the table

- Decide among various optimisation objectives: Reduce funding costs, Reducing over-collateralisation or others

- Perform what if analysis and de-risk parallel change the bank projects

- No IT development, system integration, no STP testing

- We understand your business – services and solutions are ‘by traders for traders’